pay ohio sales tax online

Cscohiogov Tax Rates Only. Collect sales tax at the tax rate where your business is located.

Ohio To Accept Bitcoin For Tax Payments Calls It Secure And Transparent Ohiostate Ohioheartbeatbill Bitcoin Btc Crypto Blockch Tax Payment Bitcoin Ohio

To file sales tax in Ohio you must begin by reporting gross sales for the reporting period and calculate the total amount of sales tax due from this period.

. A customer living in Toledo Ohio finds Steves eBay page and purchases a 350 pair of headphones. You can look up your local sales and use tax rates with TaxJars Sales Tax Calculator. Any seller which conducts business and has a major presence within the state must collect sales tax in Ohio must pay taxes to the state.

ODT Taxpayer Services 1-888-405-4039 or --. Pay ohio sales tax online Thursday March 3 2022 Edit. School District Withholding Tax Returns.

Return to Online Services. The Ohio sales and use tax applies to the retail sale lease and rental of tangible personal property as well as the sale of selected services in Ohio. File your Ohio tax return electronically for free when you use the Ohio Department of Taxations secure online services.

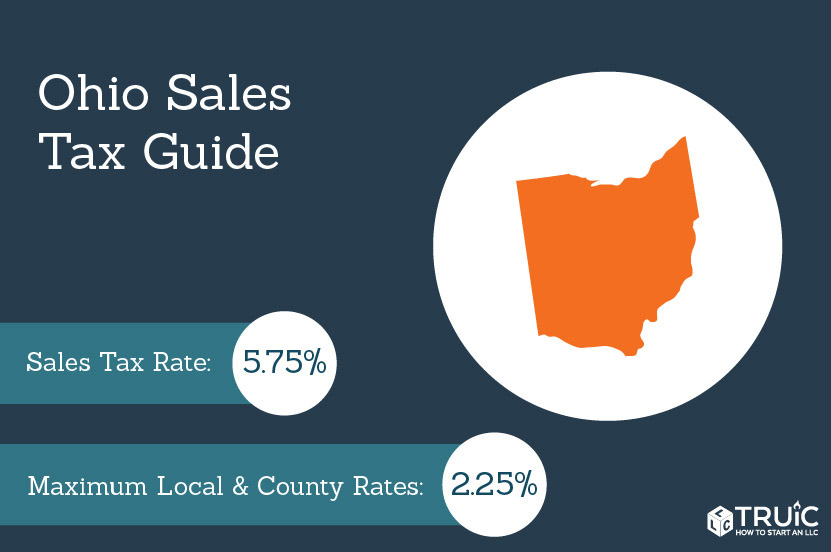

How to Get Help Filing an Ohio Sales Tax Return. IT-501 Payment of Income Tax Withheld. The state sales and use tax rate is 575 percent.

Christopher Columbus Nationality True Facts About Christopher Columbus. Warning No content found for. Available at 866-OHIO-GOV 866-644-6468 for help with filing a return answering general questions or assistance with logging in to the website.

If you are experiencing login issues please contact the Ohio Department of Taxations Service Desk at 800 282-1780. See Available Tax Returns. The state sales tax rate and use tax rate in Ohio is 575.

Offer helpful instructions and related details about Pay Ohio Unemployment Taxes Online - make it easier for users to find business information than ever. For general payment questions call us toll-free at 1-800-282-1780 1-800-750-0750 for persons who use text. Register for a vendors license.

File and pay sales tax and use tax. Save time and money by filing taxes and other transactions with the State of Ohio online. Save time and money by filing taxes and other transactions with the State of Ohio online.

Passwords are case sensitive. Register for file and pay. If you have questions or concerns about information listed on The Finder please contact.

File and pay sales tax and use tax. Payments by Electronic Check or CreditDebit Card. IT-942 Quarterly and 4th QuarterAnnual Reconciliation of Income Tax Withheld.

Ohio first adopted a general state sales tax in 1934 and since that time the rate has risen to 575 percent. Sales tax is a tax paid to a governing body state or local on the sale of certain goods and services. Welcome to the Ohio Department of Taxation Income Tax Guest Payment Service.

Offer helpful instructions and related details about Pay Ohio Estimated Tax Online - make it easier for users to find business information than ever. Ohio businesses can use the Ohio Business Gateway to access various services and submit transactions and payments with many state agencies such as. Several options are available for paying your Ohio andor school district income tax.

For general payment questions call us toll-free at 1-800-282-1780 1-800-750-0750 for persons who use text. Available 247 the departments online services can help you electronically file an Ohio IT 1040 SD 100 andor IT 10 while providing detailed instructions and performing calculations as you complete your return. How to Get Help Filing an Ohio Sales Tax Return.

Therefore these sellers required to file for a Sales tax certificate. Register for a vendors license. In transactions where sales tax was due but not collected by the vendor or seller a use tax of equal amount is due from the customer.

Top Rated Rheumatologist In Ohio. Top Craft Beers 2016 Plastic Molding For Countertops Top Plastic Surgeons Florida. Free Online 2018 Us Sales Tax Calculator For 20109 Manassas Fast And Easy 2018 Sales Tax Tool For Businesses And People From 2010 Leesburg Sales Tax Manassas Sales And Use Tax Electronic Filing Department Of Taxation.

OIT Service Desk 614-644-6860 or 877-644-6860 or -- email. The Finder is a service offered by the Office of Information Technology OITDepartment of Administrative Services. At a total sales tax rate of 725 the total cost is 37538 2538 sales tax.

For tax preparers CPAs and filing practitioners who manage multiple business accounts for multiple clients. We cover more than 300 local jurisdictions across Alabama California Colorado Kansas Louisiana and Texas. On top of the state sales tax there may be one or more local sales taxes as well as one or more special district.

For payment to or from a new or different bank account. Create a Tax Preparer Account. When calculating the sales tax for this purchase Steve applies the 575 state tax rate for Ohio plus 15 for Montgomery county.

Lastly here is the contact information for the state if case you end up needing help. Who Sales Mattresses Near Me. SD-101 Payment of School District Income Tax Withheld.

IT-941 Annual Reconciliation of Income Tax Withheld. Ohio businesses can use the Ohio Business Gateway to access various services and submit transactions and payments with many state agencies such as. In Akron for example theres a total sales tax rate of 675 due to an additional 1 due for sales in Summit County.

Income Tax Guest Payment Service allows taxpayers to schedule and remit payments for Individual and School District Income Tax via electronic check or creditdebit card without creating an Online Services account. Offer helpful instructions and related details about Ohio State Tax Pay Online - make it easier for users to find business information than ever. The Help Desk is available Monday through Friday 8 am.

Everyday Purchases Department Of Taxation

Vintage 1976 Furniture Credit Payment Book The Stewart Etsy In 2022 Lancaster Ohio Books Ohio

Kansas Getting Tough On Sales Tax Sales Tax Accounting Quickbooks

State Of Ohio Prepaid Sales Tax Stamp 1 Cent Good Cond Ohio History Ohio Ohio State

Https Myaccounts In Restaurant F Software Security Retail Software Business Data

Sales And Use Tax Electronic Filing Department Of Taxation

Ohio Sales Tax Guide And Calculator 2022 Taxjar

Poster Tax Sign 24x18in In 2022 Tax Lawyer Signs Tax

Sales And Use Tax Electronic Filing Department Of Taxation

Ohio Sales Tax Small Business Guide Truic

Don T Park It Donate It The Process Is So Easy We Ll Pick Up Your Vehicle For Free And The Proceeds From The Sale Helping The Homeless Donation Form Donate

Sales And Use Tax Electronic Filing Department Of Taxation

Pay Online Department Of Taxation

Ohio Sales Tax Holiday Approved For Back To School Sales In August Columbus Business First Propagandas

State Of Ohio Refund Cycle Chart 2014 29 Louisiana State Tax Forms Picture Louisiana State Tax Forms State Tax Chart

Ohio State Sales Tax Stamp Collection By Max Huber Stamp Collecting Ohio State Sales Tax

Ohio State Versus Throw Back Vintage Football Posters Print Ohio State Michigan Ohio State Vintage Football

Food And Beverage Will See Biggest Gains In Retail Ecommerce Sales Growth This Year Ecommerce Growth Inflection Point